ANALYSIS: Listings Are Rising ...

... prices are stabilizing. And affordable, smaller homes are becoming a distant memory.

By Martin Davis

EDITOR-IN-CHIEF

Email Martin

The July housing report recently released by the Fredericksburg Area Association of Realtors continues the steady drumbeat of previous releases this year: higher prices, longer times to sell, and increased numbers of listings.

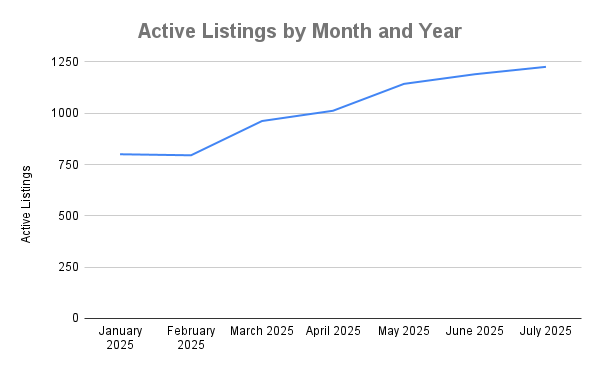

With seven full months of sales data for 2025 now available, this rising tide of homes available to buy stands out.

Rising Supply, Falling Prices?

When the number of homes listed for sale reached 1,000 this past April, the FAAR report noted that it was “the first time since October of 2022” the number of active listings was over 1,000. It went on to say that this offers “some optimism for buyers in the market who have persistently struggled with low inventory and strong competition.”

When the number of active listings moved north of 1,000 in May, the FAAR report said: “Active listings exceeded 1,000 homes again this month, only the second time since 2020 that the market has seen two consecutive months of 1,000 homes or more on the market.”

July marks four consecutive months of active listings over 1,000 (the number was 1,226 in July). FAAR chose not to focus not on the number of active listings this month, however, but rather on the tiny number of new listings.

“New listings were up a scant 0.31% from last year with 639 homes coming on the market in July of 2024 compared to 641 this year. New pending sales were up about 1% in the last month, with 542 pending contracts compared to 538 last July.”

FAAR board member Rachel Flynn was quoted in the July press release as saying that the conversations realtors are having with sellers is starting to shift: “We are discussing longer days on market to be expected and the need for flexibility and openness as we receive feedback. In addition to the already popular below $500,000 buyer pool, I’ve noticed a rise in buyer activity in the above $500,000 to $650,000 price range.”

In normal times, this rise in available supply, and longer times to sale, would suggest that housing prices are at least plateauing; at best, falling.

So far, however, this extra inventory hasn’t translated into lower prices this year. But there are signs that prices could be stabilizing.

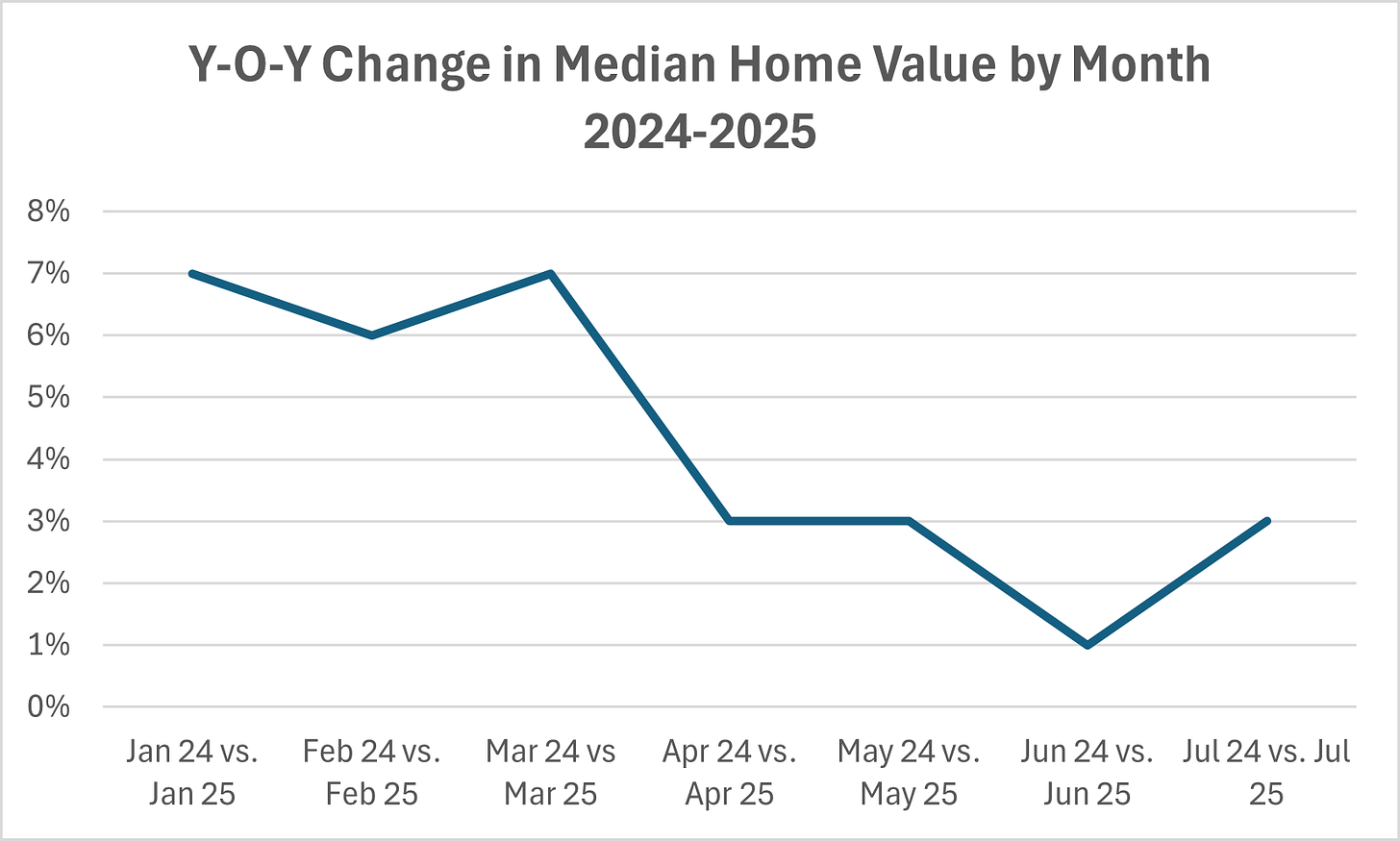

The FAAR reports usually look at pricing data year-over-year to give a sense of growth or decline. By that metric prices are up — in the area that FAAR serves the median home price is up 3% between July 2024 and July 2025. But there are indications that this year-over-year jump has been slowing.

For January, February, and March, year-over-year jumps in the median price for a home were 7%, 6%, and 7% respectively. Beginning in April — the same month that the availability of homes on the market hit 1,000 — the year-over-year jump in the median home price was 3%. In May, June, and July it was 3%, 1%, and 3%, respectively.

This flattening of the year-over-year increases in home prices shows up in relatively stable home prices for January to July of 2025.

King George County shows the sharpest rise, but the other localities reflect little fluctuation from month-to-month since the beginning of the year.

Coming into a New Normal

Trying to make sense of this information, and then project what may come, is particularly tricky right now.

“It’s always a little tricky to predict exactly where things will land over the next 12 months” wrote Coldwell Banker Elite vice president Matthew Rathbun in an email to the Advance, “especially with so many unpredictable domestic policy influences at play right now.”

However, should we stay on this trajectory, he said, “what we may be seeing is … a normalization [of prices], bringing us closer to the patterns we experienced in the pre-COVID years.”

In short, welcome to the new normal in the greater Fredericksburg housing market. If Rathbun is correct, “[t]hat would mean prices leveling out rather than accelerating at the pace we saw during the past few years,” he told the Advance. “In my view, it’s likely this pattern will sustain through the fall and winter and then give way to the natural seasonal lift we typically see at the start of the next home-selling cycle in spring 2026. Again, that assumes no significant policy issues, mass layoffs for the job secretors our market supports or dramatic economic impacts for the policy changes we’ve already seen.”

Rathbun said that the rising inventory and relative month-to-month stability in median home prices is “often an indicator that buyers and sellers are finding a more balanced footing. That balance can be healthy for the market long-term.”

A Growing Separation?

When looked at in the average, prices that are leveling out is a good thing. A closer look at the types of homes being sold, however, points to the housing issues that have plagued this region for decades, but especially since COVID.

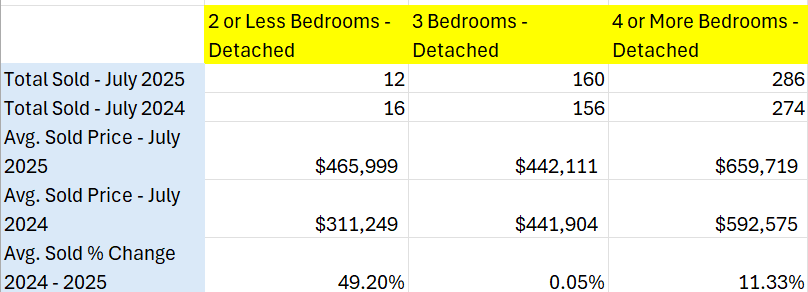

When looking at homes by the number of available bedrooms, there aren’t significant changes in the numbers sold year-over-year for the month of July.

However, what does jump out are two points in the chart above:

There were fewer 1-, 2-, and 3-bedroom homes combined sold, than homes with 4 bedrooms.

The prices for 1- and 2-bedroom homes have jumped significantly more that for homes with 3 or 4 bedrooms.

In short, people looking for smaller homes aren’t finding many to choose from, and when they do the prices are up significantly from just a year ago.

People who can afford larger homes aren’t seeing prices rise nearly as fast, and they’re enjoying more options to choose from.

In other words, normalizing prices aren’t translating into more options for all buyers — just buyers on the upper end of the scale.

As the community talks about affordable housing, these numbers deserve close scrutiny.

Yes, we need more houses built. But we also need smaller houses built. Increasing this supply should, theoretically, put downward pressure on those homes’ prices.

If we’re to accommodate our growing population in homes they can actually afford, the answer appears clear — build, baby, build. And build smaller.

Local Obituaries

To view local obituaries or to send a note to family and loved ones, please visit the link that follows.

Support Award-winning, Locally Focused Journalism

The FXBG Advance cuts through the talking points to deliver both incisive and informative news about the issues, people, and organizations that daily affect your life. And we do it in a multi-partisan format that has no equal in this region. Over the past year, our reporting was:

First to break the story of Stafford Board of Supervisors dismissing a citizen library board member for “misconduct,” without informing the citizen or explaining what the person allegedly did wrong.

First to explain falling water levels in the Rappahannock Canal.

First to detail controversial traffic numbers submitted by Stafford staff on the Buc-ee’s project

Our media group also offers the most-extensive election coverage in the region and regular columnists like:

And our newsroom is led by the most-experienced and most-awarded journalists in the region — Adele Uphaus (Managing Editor and multiple VPA award-winner) and Martin Davis (Editor-in-Chief, 2022 Opinion Writer of the Year in Virginia and more than 25 years reporting from around the country and the world).

For just $8 a month, you can help support top-flight journalism that puts people over policies.

Your contributions 100% support our journalists.

Help us as we continue to grow!

This article is published under Creative Commons license CC BY-NC-ND. It can be distributed for noncommercial purposes and must include the following: “Published with permission by FXBG Advance.”