ANALYSIS: More Expensive, Aging Buyers, Fewer Children

Real estate reports offer more than insights into how much money is being made selling homes - they offer a reflection of our society and its challenges.

By Martin Davis

EDITOR-IN-CHIEF

Email Martin

The challenge with any data is seeing the human faces behind the numbers.

The monthly sales reports listed by the Fredericksburg Area Association of Realtors tell us a lot about the health of the housing market for buyers and sellers. But understanding who those buyers are is a more difficult proposition.

The October housing report that was released November 12, for example, had some good news for individuals concerned about housing supply.

There were 969 active listings at the end of October in 2024 compared to 1,382 at the end of this October. Active listings have posted monthly year-over-year gains for almost two years now and the market has exceeded 1,000 homes since April of this year, providing significantly more choice and options for would-be buyers. [Emphasis added]

But while listings are up creating more choice and options, in the two localities that drive the real estate market in Planning District 16 — Spotsylvania and Stafford — home prices continue to rise.

The median cost of a new home in Spotsylvania is now $469,450 (up 5% year-over-year), and in Stafford it’s $525,000 (also up 5% year-over-year).

Are those numbers affordable?

Some back-of-the-envelope math reveals that Spotsylvania remains affordable, but just barely, for a household making $109,834 per year — the average household income in the county. (This number is from 2023, the most-recent available from the Federal Reserve Bank of St. Louis.)

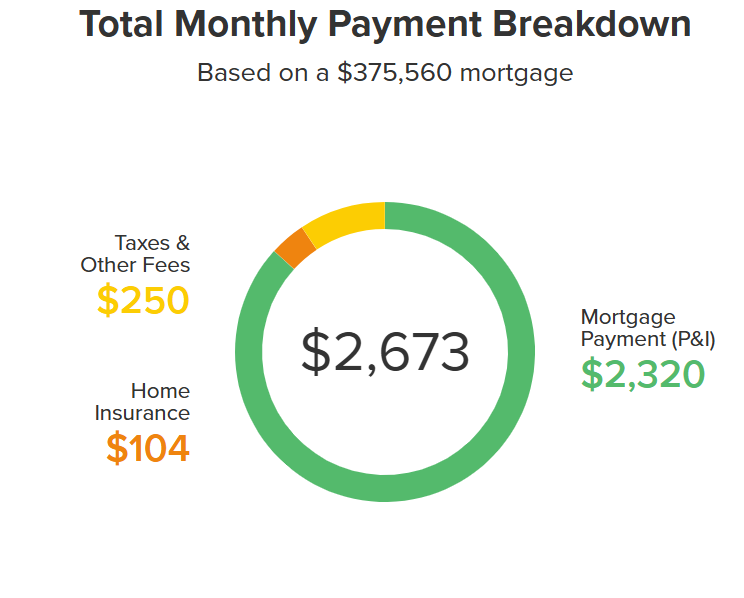

Assuming the median sales price of $459,450, with a 20% down payment ($93,890), an interest rate of 6.28%, and a 30-year fixed-rate mortgage, the monthly payment would come to $2,673 a month.

This payment is just inside the 30% threshold for how much of an average household’s annual income should go to housing — $2,673.

In Stafford County, the average household income is $130,751, meaning a family should spend no more than $3,268 per month on housing. A $525,000 home in Stafford generates a monthly mortgage payment of $2,977, assuming 20% down ($105,000), a 6.28% interest rate, and a 30-year fixed mortgage.

So in both counties, housing prices are theoretically within reach of buyers whose households make at least the average income.

But the economics of home buying are making it harder for younger families just starting out to purchase that first home.

Fewer, Older, Childless: First-time Buyers

While the Fredericksburg Area Association of Realtors does not collect first-time home buyer data, the National Association of Realtors does, and a report released this year examining the profile of first-time homebuyers between July 2024 and June 2025 gives some insight into what high prices, interest rates, and a shortage of smaller homes means for people looking to become homeowners. (The full report can be downloaded at the end of this column.)

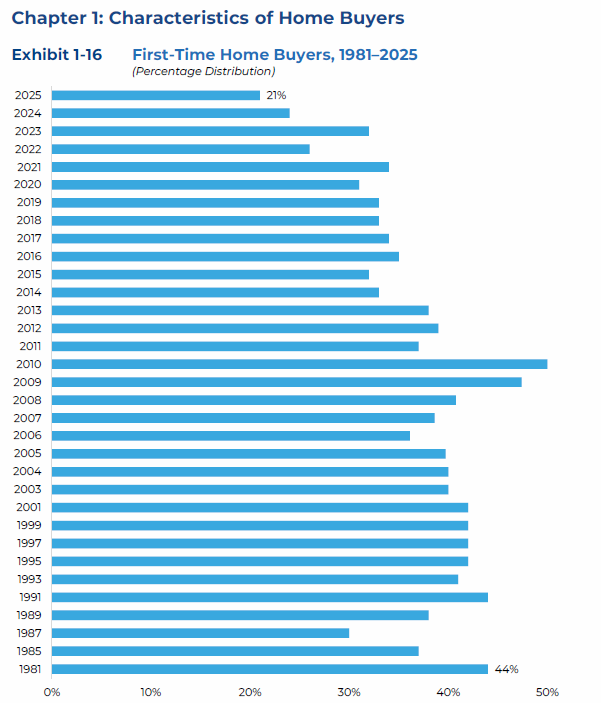

First-time homebuyers are shrinking in number — The 2025 report shows that first-time home buyers “shrank to a historic low of just 21 percent of all buyers.” At no time since the NAR started keeping data has the percentage been that low.

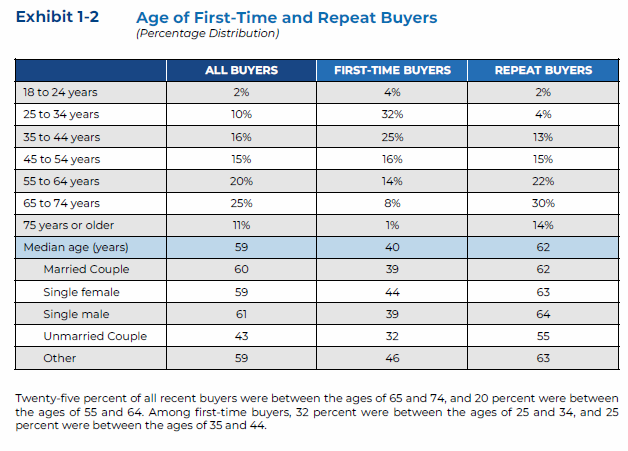

People are waiting longer, much longer, to buy a home — In the 1980s, first-time buyers tended to be in their late 20s. Today, the median age of first-time home buyers is 40.

When broken out by marital status, the youngest first-time home buyers are unmarried couples (32), with single females being the oldest (44).

No surprisingly, the number of first-time home buyers without children, therefore, continues to plummet. This trend started in the 1980s, when housing was more within reach of younger buyers and reflects the overall cultural move of delaying people having their first children. In recent years, as the graph below shows, it is accelerating. This acceleration coincides with the onset of COVID, when housing prices began to surge.

While the trend toward fewer first-time home buyers having children when they buy is more likely tied to cultural shifts in when people start families as it is to the cost of home, the high costs are a significant factor in people waiting longer to buy. According to the report:

First-time buyers who are successful in purchasing cite high rent and student loans as two foremost costs that hold them back from saving.

Bottom Line

Yes, when one looks at affordability through the lens of median home prices and average salaries, the two largest drivers of home sales in the Diamond — Spotsylvania and Stafford — are “affordable.”

Higher costs and restricted supply, especially of smaller homes, however, is forcing people to wait longer than they might like to move into that first home.

So while the market by the numbers may be healthier, the faces behind the numbers reveal a far more challenging reality.

Local Obituaries

To view local obituaries or to send a note to family and loved ones, please visit the link that follows.

Support Award-winning, Locally Focused Journalism

The FXBG Advance cuts through the talking points to deliver both incisive and informative news about the issues, people, and organizations that daily affect your life. And we do it in a multi-partisan format that has no equal in this region. Over the past year, our reporting was:

First to break the story of Stafford Board of Supervisors dismissing a citizen library board member for “misconduct,” without informing the citizen or explaining what the person allegedly did wrong.

First to explain falling water levels in the Rappahannock Canal.

First to detail controversial traffic numbers submitted by Stafford staff on the Buc-ee’s project

Our media group also offers the most-extensive election coverage in the region and regular columnists like:

And our newsroom is led by the most-experienced and most-awarded journalists in the region — Adele Uphaus (Managing Editor and multiple VPA award-winner) and Martin Davis (Editor-in-Chief, 2022 Opinion Writer of the Year in Virginia and more than 25 years reporting from around the country and the world).

For just $8 a month, you can help support top-flight journalism that puts people over policies.

Your contributions 100% support our journalists.

Help us as we continue to grow!

This article is published under Creative Commons license CC BY-NC-ND. It can be distributed for noncommercial purposes and must include the following: “Published with permission by FXBG Advance.”

The shift toward older first-time buyers is striking. A median age of 40 represents a massive demografic change from the 1980s. What concerns me most is how this delyed entry into homeownership affects family formation and wealth building. When people wait until 40, they miss out on years of equity accumulation that previous generations had. The impct on retirement savings and generational wealth transfer could be profound.