ANALYSIS: The Real Estate Market May Be Nearing a Tipping Point ...

... but not one that we're accustomed to seeing.

By Martin Davis

EDITOR-IN-CHIEF

On the surface, the real estate market in Fredericksburg and its two most-populous surrounding counties tell much the same story that it has been telling us for months.

Prices are up—again. The press release issued by the Fredericksburg Area Association of Realtors on November 11 noted that “The regional median home price was up year-over-year for the 18th month in a row this October.”

Inventory, though improving, remains relatively tight. Data comparing new listings from 2023 and 2024 against listings from 2019 to 2022 show the gap. (See the graph below.)

Traditionally, these problems are corrected in one of two ways. First, a burst in building creates more homes, thus more units that in turn keep prices within reach of more Americans. Second, interest rates bottom out, allowing people to afford higher-priced homes.

This region has been a seller’s market for an extended period of time, owing in no small part to a limited inventory of homes. This is why the city of Fredericksburg in particular has been abuzz recently about density and creating affordable housing opportunities.

Though there’s much discussion about increasing inventory, it’s a slow, evolutionary process that is going to take time.

Interest rates, on the other hand, are largely beyond our control. And there’s no doubt that their elevated rates are keeping more people on the sidelines when it comes to homebuying. And it’s unlikely that we’re going to see those mortgage rate numbers drop rapidly in the near future.

Right now, these two factors are working against both sellers and owners in the home-buying process.

Homeowners are sitting on a lot of equity. So when a buyer looks for concessions from sellers in order to lower the buyer’s overall closing costs, the homeowner has little incentive to move.

Gary Gardiner Jr., managing broker with Gardiner Group Real Estate, tells the Advance in an email that, “As we complete Q4 2024 and enter the 2025 housing market, many buyers remain hopeful that mortgage rates will trend downward and overall sales pricing will stabilize at a lower % of increase to make affordability less of a strain on their overall budget and a home purchase much more achievable in the near future.”

But there’s a third factor that may be coming into play in our area that is putting a drag on home sales — worker income.

Worker Income and Inflation

On the surface, wage increases have been a significant boom for workers over the past couple of years. Statista, for example, reports that “In September 2024, inflation amounted to 2.4 percent, while wages grew by 4.7 percent. The inflation rate has not exceeded the rate of wage growth since January 2023.”

But the recent growth in wages tell only part of the story.

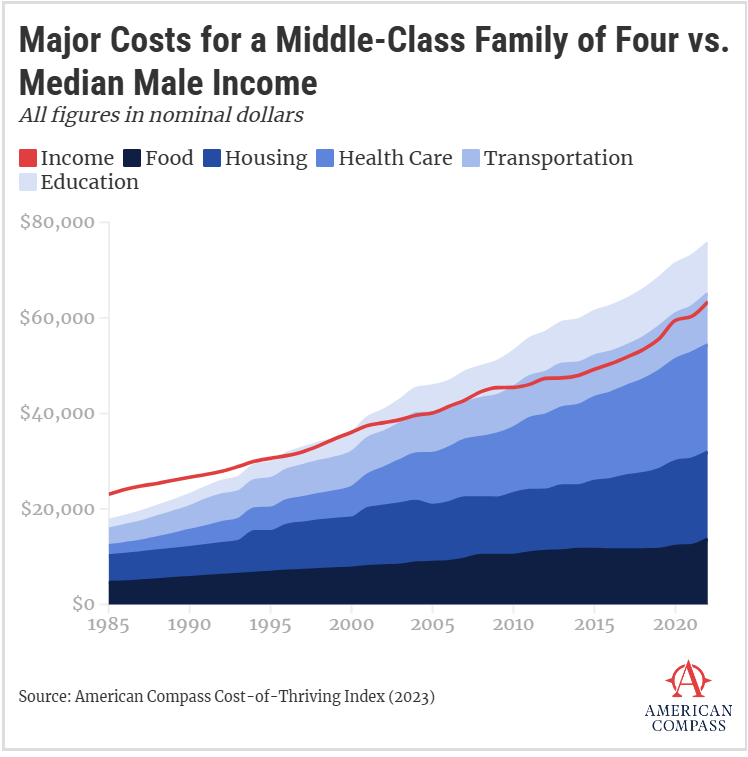

American Compass has tracked a metric called the “Cost of Thriving Index,” which “measures the number of weeks a typical worker would need to work in a given year to earn enough income to cover the major costs for a family of four in the American middle class in that year: Food, Housing, Health Care, Transportation, and Higher Education.

A look at CTI since 1985 shows the diminishing buying power Americans have experienced. And this data set stops at 2022, just as the massive inflationary spiral set in for Americans.

Bank Rates 2024 Wage to Inflation Index puts a finer point on the problem.

Economists have celebrated inflation’s rapid descent, and perhaps even more, the relatively little pain it’s caused the U.S. job market. For over a year now, wages have been rising faster than inflation as prices slow and the job market holds up, giving Americans an opportunity to recover the buying power that they lost after ultralow interest rates, supply shortages and a stimulus check-fueled spending boom combined to form the worst inflation crisis in 40 years.

But the race isn’t over yet. The past 16 months of “real” wage growth — as economists have called it — haven’t been enough to offset the 25 months where prices were rising disproportionately faster than Americans’ paychecks, according to a new analysis of Bureau of Labor Statistics data from Bankrate.

Virginians are feeling this pain.

According to the United Way, the number of homes living either in poverty or that are identified as ALICE (Asset Limited Income Constrained Employed) has grown since 2019.

“In 2019, 1,213,684 households in Virginia were below the ALICE Threshold; by 2022, that number had changed to 1,337,175. Use the buttons below to switch between ALICE data over time by number and percentage.”

Again, the data here cuts off at 2022. But there are other indicators that people in our region are struggling with basic needs.

In September, CEO and president of the Fredericksburg Area Food Bank Dan Maher appeared on the New Dominion Podcast and talked about how food insecurity is worsening in our region — and across the country — despite the rise in wages and the relatively lower inflation rates.

He cites United States Department of Agriculture data that showed in 2022 the jump in food insecurity was the highest in 14 years. And in 2023, that number grew by 6%. A number that puts us where we were during the Great Recession. So today, roughly 1 in 7 Americans are food insecure.

And he notes that food insecurity is tied to other issues. People, he said, are “lamenting that food is one symptom of what they struggle with. Housing costs and the way that undercuts people ability to manage their household finances is a critical factor in food insecurity.”

Tipping Point

All of this is to say that the surging cost of housing, coupled with relatively sluggish supply, is putting a pinch on people’s ability to buy. Pinches that are being felt not just in whether or not they can buy a home, but also whether they can afford basic needs.

That fact is reflected in a quote that ended FAAR’s press release yesterday.

“FAAR Board of Director member Dawn Curry comments, ‘For me and my clients, the market has been consistent with a typical seller's market. Housing prices have remained strong with appraisals coming in at value. Days on market have been longer than we've been used to over the past year, but it seems we have fewer qualifying buyers.’”

For now, FAAR member and realtor Randy Walther tells the Advance, “there is still a sizeable population that can buy in this market and it doesn't appear to be abating.”

The operative question may well be becoming, however, will that sizeable market continue to grow? Or will the inflationary pressures that have cut into workers’ salaries continue to bite into people’s abilities to afford to purchase a home?

For a full breakdown of the housing market in your community, please follow the links below

Caroline County

City of Fredericksburg

King George County

Orange County

Spotsylvania County

Stafford County

Colonial Beach

Local Obituaries

To view local obituaries or to send a note to family and loved ones, please visit the link that follows.

Support Award-winning, Locally Focused Journalism

The FXBG Advance cuts through the talking points to deliver both incisive and informative news about the issues, people, and organizations that daily affect your life. And we do it in a multi-partisan format that has no equal in this region. Over the past year, our reporting was:

First to report on a Spotsylvania School teacher arrested for bringing drugs onto campus.

First to report on new facility fees leveled by MWHC on patient bills.

First to detail controversial traffic numbers submitted by Stafford staff on the Buc-ee’s project

Provided extensive coverage of the cellphone bans that are sweeping local school districts.

And so much more, like Clay Jones, Drew Gallagher, Hank Silverberg, and more.

For just $8 a month, you can help support top-flight journalism that puts people over policies.

Your contributions 100% support our journalists.

Help us as we continue to grow!