Local Housing Market Signals Changes in Economy?

The local housing market, like the markets for other industries, may be showing signs of the growing gap between the wealthiest families and middle-class families.

By Martin Davis

EDITOR-IN-CHIEF

Email Martin

The monthly housing report had hopeful news for prospective buyers: the median price of homes in our area has dropped.

In the post-COVID market reality, however, what that means is difficult to tease out.

Price Drops Aren’t Equally Distributed

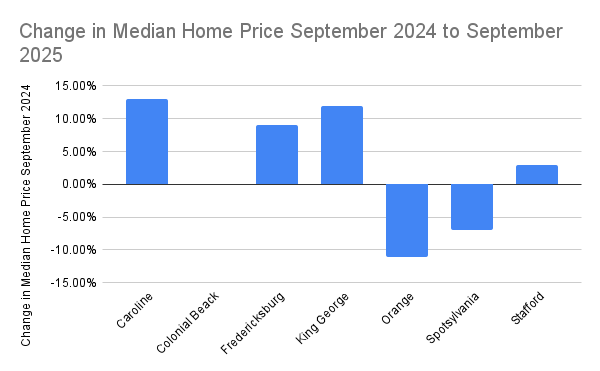

While the region covered by the Fredericksburg Area Association of Realtors realized an overall 2-percentage-point decline in the median sales price year-over-year from September 2024 to September 2025, only two localities saw median prices drop — Orange and Spotsylvania.

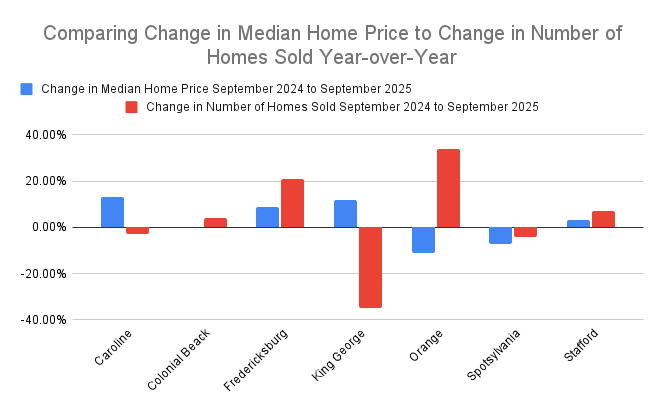

The picture muddies when the year-over-year change in median home sales price is juxtaposed to the year-over-year change in the number of homes sold.

Of the seven localities in the region FAAR covers, only one — Spotsylvania — realized declines in both median home price and number of homes sold.

This is more noteworthy than the overall modest decline in median home prices across the region because 33% of all homes sold in FAAR’s region — 159 — were sold in Spotsylvania.

Further, Spotsylvania and Stafford account for 63% of all homes sold in the FAAR region.

Looking at the real estate market through the two dominant localities in the region changes the calculus of how we understand what is happening in the housing market.

The question becomes why is Spotsylvania falling as Stafford continues to see increases?

The answer may lie in the overall economy.

Serving the Higher-End Buyer

In a number of important areas, higher-end buyers are driving the U.S. economy, and businesses are responding accordingly.

Consider the automotive market, where Kelly Blue Book announced on Monday that for the first time, the average cost of a new car in the U.S. topped $50,000.

Erin Keating of Cox Automotive told Forbes that, “Today’s auto market is being driven by wealthier households who have access to capital, good loan rates, and are propping up the higher end of the market.”

A similar trend is affecting the vacation market. Last month the New York Times published an essay arguing how Disney World, once a staple vacation spot for middle class families, is now catering to higher-income families.

“For most of the park’s history,” the essay said, “Disney was priced to welcome people across the income spectrum, embracing the motto ‘Everyone is a V.I.P.’ …. Back then, America’s large and thriving middle class was the focus of most companies’ efforts and firmly in the driver’s seat. That middle class has so eroded in size and in purchasing power — and the wealth of our top earners has so exploded — that America’s most important market today is its affluent.”

Is it possible that this trend is affecting the real estate market in our region?

Spotsylvania’s median home price in September 2025 was $459,000. While that number is still too high for many middle-class families in our region, it pales next to Stafford’s median home price of $519,000.

Spotsylvania has been a haven for people moving into our region since 2000, featuring homes that catered to middle-class tastes at prices below those just to the north.

Inflation and wage stagnation, however, are hitting middle class families harder than higher-income families, pricing many out of markets (cars and vacations) that just five to ten years earlier they could access.

That could explain why, even with less-expensive homes, Spotsylvania is beginning to drag while Stafford continues to rise.

Still Searching for ‘Normal’

Spotsylvania’s negative numbers and Stafford’s positive numbers make them the counties to watch in coming months as a measure of the overall health of the housing market.

Should the trend of Spotsylvania’s median home prices and home sales continue to drop, and Stafford’s continue to rise, it may indicate that the wealth gap is taking hold in our region with clear winners and losers.

That’s great news for people on the upper end of the economic spectrum. For middle class families and others, however, it means gaining access to homes will only get more challenging. Not because the homes aren’t available, but because it’s becoming more difficult for families to find the resources to buy.

More Destabilizing Pressures

Complicating all of this is the ongoing government shutdown. Typically, these are short-term concerns. The government does reopen, people go back to work, and lost pay is restored.

This shutdown, however, is different in some critical ways. The Trump Administration has threatened to withhold lost salaries from many government workers, and the Office of Personnel Management has begun following up on its promise to fire federal workers.

Our region is particularly vulnerable to these pressures.

In short, there is nothing normal about the times we are in, or the housing market in our region.

How all this plays out won’t be known until the spring.

This real estate report, however, suggests some worrying signs about the overall health and direction of our economy.

Local Obituaries

To view local obituaries or to send a note to family and loved ones, please visit the link that follows.

Support Award-winning, Locally Focused Journalism

The FXBG Advance cuts through the talking points to deliver both incisive and informative news about the issues, people, and organizations that daily affect your life. And we do it in a multi-partisan format that has no equal in this region. Over the past year, our reporting was:

First to break the story of Stafford Board of Supervisors dismissing a citizen library board member for “misconduct,” without informing the citizen or explaining what the person allegedly did wrong.

First to explain falling water levels in the Rappahannock Canal.

First to detail controversial traffic numbers submitted by Stafford staff on the Buc-ee’s project

Our media group also offers the most-extensive election coverage in the region and regular columnists like:

And our newsroom is led by the most-experienced and most-awarded journalists in the region — Adele Uphaus (Managing Editor and multiple VPA award-winner) and Martin Davis (Editor-in-Chief, 2022 Opinion Writer of the Year in Virginia and more than 25 years reporting from around the country and the world).

For just $8 a month, you can help support top-flight journalism that puts people over policies.

Your contributions 100% support our journalists.

Help us as we continue to grow!

This article is published under Creative Commons license CC BY-NC-ND. It can be distributed for noncommercial purposes and must include the following: “Published with permission by FXBG Advance.”

Unfortunately, this is merely a symptom of two trends.

The ongoing long term of favoring the rich, with the middle class and poor coming along for the ride with a promise that the wealth would "trickle down", which - truth be told, it did, for a while.

Now days, everyone demonizes the rich and corporations for globalization of manufacturing, and the outsized impact that has had on American middle class opportunities and strategic economic security.

Yet the ones screaming the loudest - MAGAs - were also the ones that were happiest in the 90's to buy their stuff dirt cheap at Walmart. Despite warnings from unions and others regarding the eventual impacts.

As were those with 401Ks and Roths as the stock market has enjoyed unprecedented growth over that same period due to TINA (There Is No Alternative) policies, with interest rates deliberately suppressed by government policy despite long term liabilities such as Social Security and the deficit being ignored and discounted.

Yet the problem was never globalization. It was dishonest globalization.

To where we insisted that American factories not pollute the water, land, or air; yet we're more than happy to buy from Chinese factories that were allowed to.

Where American jobsites had to provide for worker safety, but we happily bought from Pakistani companies that did not.

Wages, child labor, slave labor, basic human rights - we rewarded those who ignored those things abroad. All for cheaper prices at the moment. And likewise looked the other way locally on farmlands, construction sites, and factories as they hired illegal immigrants.

That wasn't just the rich doing that, that was everybody. Still is, to an extent. Why you think Republicans insist on enforcing immigration laws in Democratic cities, yet not in the Republican strongholds that were screaming for it the loudest?

Because they know they can't afford it. The other day, even that idiot Joe Rogan was backing off of it. Suddenly "realizing" what we've all known all along. The reason they are here is because we want them and we hire them.

Yet many of our most self righteous brethren talk about if they were alive in the 1860's, no way they wouldn't have done the right thing about slavery in the South.

But we've happily profited from the labor of Uyghurs as much as any Northern factory ever did the cheap cotton chopped by slaves in 1860. We don't see it, so we ignore it. No different than then.

So how could American manufacturing compete when we didn't demand a fair playing field between them and those they competed against? Not only on the things that corporations cared about, but those we say we value as a nation?

Our capitalism has been dishonest, and rather than address it; we have lowered ourselves to our worst enemies' level.

Hardly what I would call progress.

What we have been enjoying is dishonest capitalism, rather than free markets - with both Republican and Democratic policy makers favoring short term happiness over long term security - because that's what the grasshopper voters have wanted.

It's a bubble that has been destined to eventually fail. I suspect we're seeing it.

No wonder we have chosen to be led at so many levels by a party whose god is a fraudulent felon who specialized in bankruptcy, grift, self-promotion, and lies.

Coupled with arrogance, a religious viewpoint of self-entitlement and greed that truly believes that laws do not apply to them, and that they are destined by God to rule the rest of us as they wish.

Because the other trend, due to that bubble, is wealth inequality; which has worsened for two generations to where we truly do live side by side, yet in two separate worlds.

Recent reports indicate that those earning over $250k/year are providing over 50% of current consumer spending.

It's not surprising folks like Disney cater to them. They have to if they want to survive.

If that's not you, or if you are not expecting your children or your children's children to be on the good side of that 96%-4% spit - you might want to consider if this is still going to work for you and yours. You may be staying ahead of those behind you, but that does not necessarily mean you're progressing.

It's like the man said, if there's a doubt, then there is no doubt.....

And yet, again, this trend is merely a symptom.

Of the increasing divide between the haves and have-nots. With the playbook being followed here by Republicans being the same one recently followed by totalitarians in the Philippines, Russia, India, Turkey, Israel.

It's no wonder Trump embraces them over democracies. With Argentina bailed out for $20 billion that benefits Bessent's hedge fund buddies, at the same time China is buying $20bn in soy beans from them instead of America, and American taxpayers end up spending $50 billion here to bail out Trump's farmer constituents even though they are only losing 15-20bn from his policies. All at our expense, and either on a credit card, or paid for by tariff-taxes on the people who can afford it the least.

Those with the power using that power not to rise up all citizens, but only those of their party.

The military gets paid, but no one else. Tax dollars are distributed by party loyalty, not need. Likewise laws enforced. Military used to occupy political opponents cities. Rights suppressed. Courts coerced or ignored. Laws dismissed. Markets altered. Arbitrary killings, arrests, indictments.

So you say you're a little worried about local housing prices? That might be the least of your worries.

Even if you do not oppose such horrendous injustices and theft because you are an American/human that believes in civil liberties, rule of law, or just common human decency - as evidenced by the above financial news - if you're not among the 3.2% of Americans who do make more than $250k/year - could we at least trouble you to pretend to believe in those things because they're in your financial interest?

Just a thought.