NEWS: Not an Easy Budget

Stafford is now paying the piper for unfunded state mandates and some prior Board decisions. But there is a bright spot down the road.

By Martin Davis

EDITOR-IN-CHIEF

Email Martin

There weren’t a lot of smiles around the dais in Stafford County Tuesday night. County Administrator Bill Ashton unveiled a budget that he described as “not an easy budget, but it’s an honest one.”

Honesty, as the saying goes, sometimes hurts.

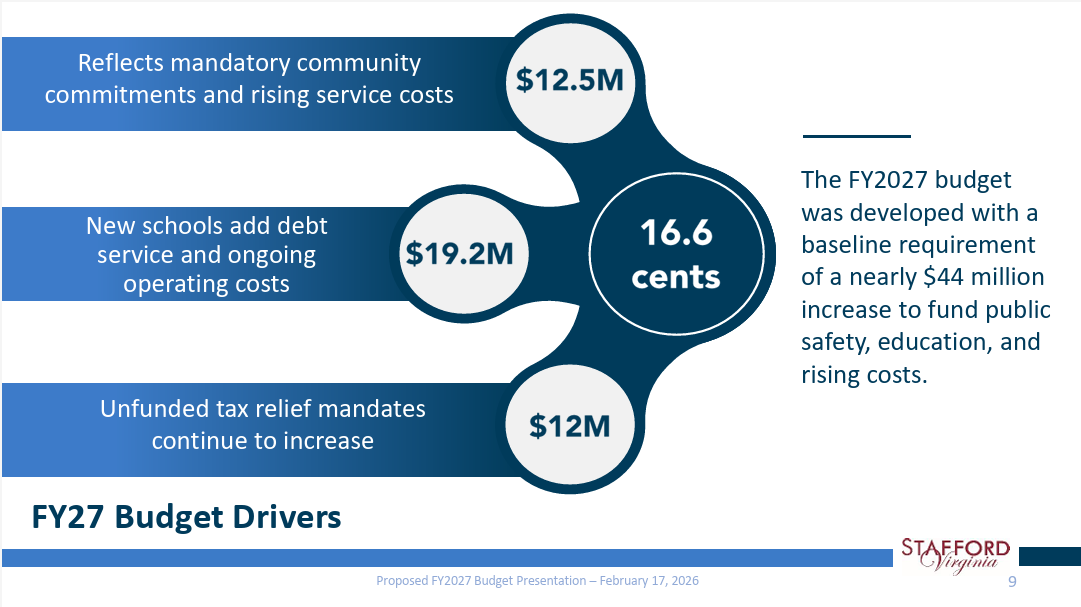

The challenges facing the county were made apparent quickly when Ashton said that the FY2027 budget started with a baseline requirement that included $44 million in increased funding for public safety, education, and rising costs.

Just to meet these baseline requirements, the county would had to have issued a tax increase of 16.6 cents. That number was a “nonstarter,” Ashton said.

Instead, he is proposing a roughly 6-cent increase over 2026’s approved budget rate to 0.985 cents, coupled with a series of cuts.

Decisions made at the local and state levels over the past several years have put the county in this bind. The pressures that Stafford is facing, Ashton said, “are unprecedented. I’ve never seen it in 29 years” of government service.

Budget Increases

Education

The county is prioritizing education by adding $24 million to support the system. The increases are in three areas:

New school operations and public day school increases — $10.5 million

Pay increases for teachers and staff — $4.5 million

Three new schools’ impact to debt service — $9 million

Ashton’s presentation noted that educational debt now accounts for about 80% of the county’s debt.

Public Safety

In 2023, the Stafford Board of Supervisors approved a significant increase in pay for the county’s Sheriff’s Office. According to a report from the office, the increase that took effect in FY 2024 included an “8% salary scale adjustment for the ranks of 1st Lieutenant and above. This was implemented after the ranks of 1st Sergeant and below received a 15% salary scale adjustment.”

The issue was that the increase, which was championed by Rock Hill Supervisor Crystal Vanuch, was paid for with ARPA funds distributed by the federal government in response to COVID.

The county is now honoring those raises by absorbing the cost of continuing to fund that new salary scale for the Sheriff’s Office with county funds.

Tax Relief

The ongoing problem of state-mandated tax relief for disabled veterans continues to be a drain on the county’s budget. There is also relief for some seniors, but veterans represent the lion’s share of the relief, according to Ashton.

According to the presentation, those reliefs are projected to be $40 million.

Other

The county is also addressing two additional rising costs.

4% adjusted compensation across public safety and general government

$1.6 M health insurance benefit

Cuts

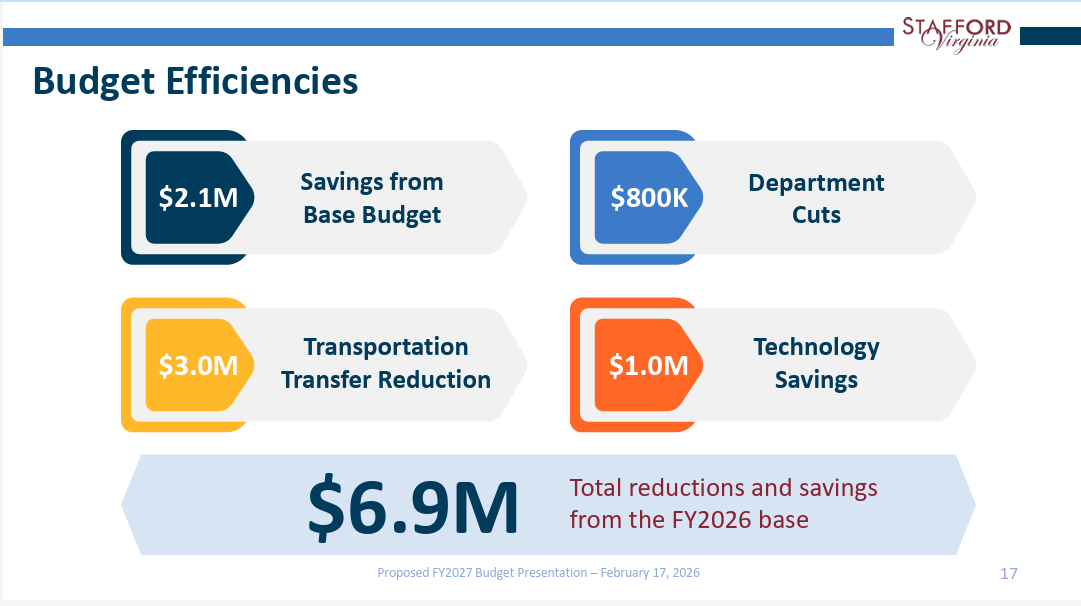

To deal with these increases, the county is making $6.9 million in cuts to the budget.

These cuts include asking all departments to find savings of 2% in their budgets.

It also means that there will be just two new employees approved — both “budget neutral,” according to Ashton — while 81 requested positions will not be funded.

What it Means for Taxpayers

The current average property tax bill in Stafford is $4,237. Should the board adopt the new tax rate, the county is projecting a average tax bill of $4,700 next year. That works about to about $38 additional dollars per month for homeowners.

A Bright Spot

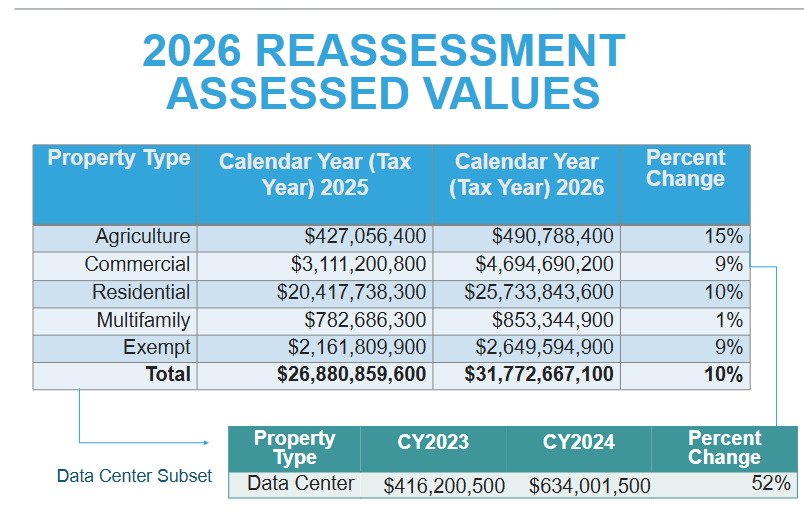

Prior to Ashton’s budget presentation, Commissioner of the Revenue Scott Mayausky delivered a presentation on reassessments, which went out in the mail last week.

There were substantial boosts in values since the last reassessment two years ago, with the value of agricultural land up 15% and residential property up 10%.

The number to watch, however, is the commercial values. Up 9% year-over-year to $4.7 million, that growth is driven overwhelmingly by data center tax revenues. As they continue to build out in the county, it will make a significant difference not just in how much money the county has to play with, but with the tax burden that citizens will have to carry.

Currently, 83% of tax revenues are born by people paying residential property taxes.

That number should go down as data centers come online.

Mayausky noted that prior to data centers coming online in Prince William County, the tax burden was also overwhelmingly born by residential property taxes. However, “with all the data centers they built, I believe their last annual report, they were up to about 34 percent of their base now being commercial.

A Long Bridge

Still, Board members expressed concerns about how these changes are going affect taxpayers now and into the near-term while the data center buildout is done — a process that will take at least four more years.

Board Chair Deuntay Diggs said that “I am worried about fixed-income citizens who can’t bear this increase.”

Tinesha Allen’s concerns were mixed with a healthy dose of frustration

“I warned that this would happen,” she said. “We’re trying to pay our bills and maintain. … It’s a 6 cent increase that just covers our mandated discounts.”

To Learn More

Next Budget meeting — February 24 — Budget Work Session

Local Obituaries

To view local obituaries or to send a note to family and loved ones, please visit the link that follows.