Thursday April 20, 2023

ANALYSIS: Taxes Done? | NEWS: We're Growing

Note from the Editor: The interview with Ben Litchfield originally scheduled to run today, will instead appear this coming Monday.

ANALYSIS: Taxes Done?

Take some time to appreciate how lucky we are, and what our tax system is costing us

by Martin Davis

Like so many Americans, I’m a procrastinator when it comes to taxes. In fact, one study finds that nationwide, almost one-third of Americans are right there with me.

I’m slow to file not because I have some fancy investment strategy that pays dividends by delaying my tax filing as long as possible, or because I have a particularly disdainful attitude toward taxes – though like most, I’m not thrilled to write an end-of-year check to the state or federal governments.

In general, I delay because I find the filing system itself particularly onerous and simply prefer to delay the whole ordeal until baseball season is underway. Somehow, wrestling with TurboTax (and its outrageous fees) is easier while watching the Nats or Orioles play on the diamond. Tax Day this year was divine, because the Nats and Orioles were playing one another.

This year, however, I delayed for another reason. I’ve spent considerable time seriously weighing the ongoing venting about high taxes that it’s a rite of passage of many people, against the realities of the community that I live in.

Since 1986, when Grover Nordquist rolled out the Taxpayer Protection Pledge, the mantras that taxes are too high, and every tax is a bad tax, has become accepted dogma.

That dogma has come home to roost in our region.

Before looking local, however, let’s step back and have a look at just how onerous our taxes are (or are not).

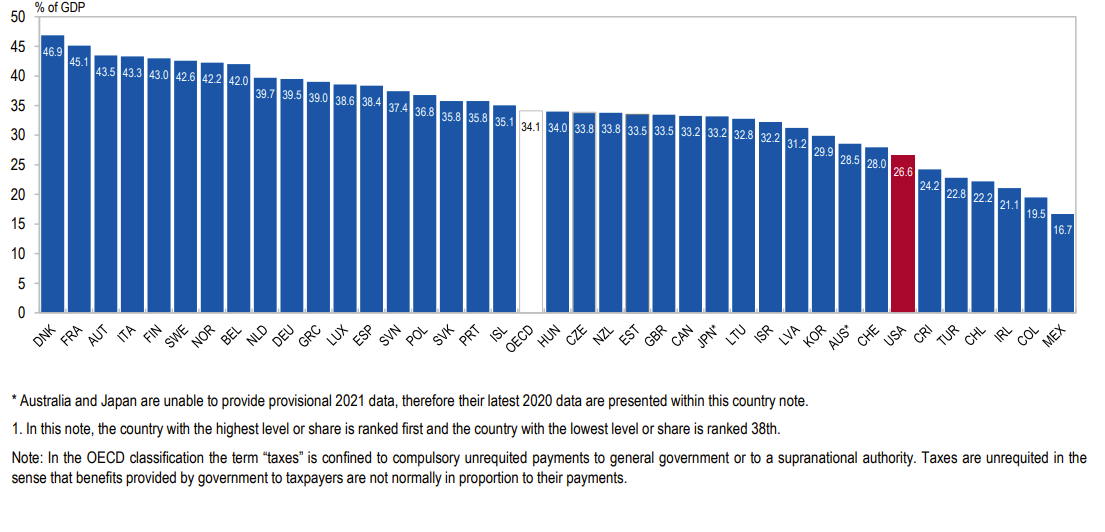

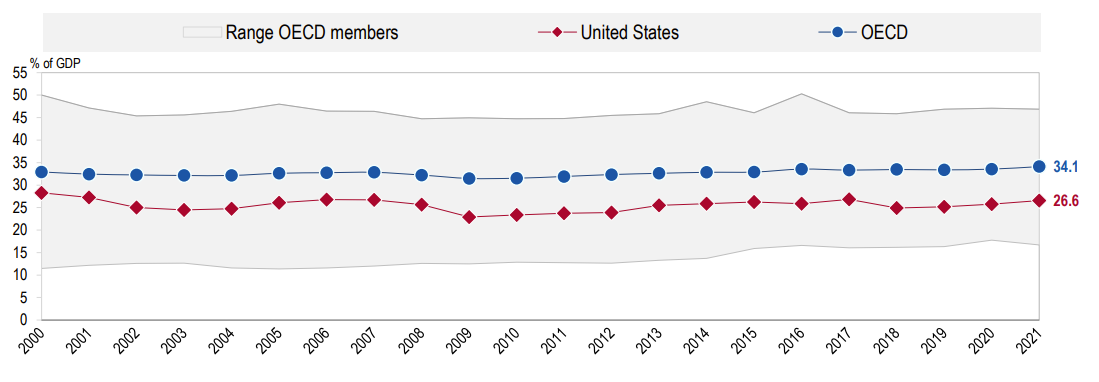

At the federal level, the United States has one of the lowest tax to GDP ratios when compared against the 38 countries in the OECD. In fact, the U.S. ranks 32nd out of the 38 countries, with a tax to GDP ratio of just 26.6%. That’s lower than Canada, Great Britain, Japan, and other nations we compete directly against. We’re only ranking higher than Turkey, Chili, Ireland, Columbia, and Mexico.

And this is not a new reality. The US has trailed the OECD average since at least 2000.

At the state level, Virginia’s tax rate falls somewhere in the middle of the pack. According to MoneyGeek, a Virginia couple with one child and owns a home valued at $349,400, and earns the average national income of $82,852, would pay about $8,000 in taxes. That puts it in the middle of the country.

The group also grades states on how tax-friendly they are. Virginia earns a C. Right in the middle.

To be sure, we’re higher than some, but to consider Virginians’ state tax burden as onerous, as Gov. Glenn Youngkin continues to do, is a bit of a stretch.

Finally, to look at the local level, I turned to tax-rates.org. The highest property taxes in the state, unsurprisingly, are in Northern Virginia. Tax-rates.org pegs Falls Church City as the highest in the state at $6,005, or 0.94% of the median home value. Buchanan County, by contrast, has the lowest rate - $284, or 0.46% of the median home value.

Where do the counties in our town come in?

Spotsylvania: $1,668

Fredericksburg: $1,865

Stafford: $2,477

Even with the proposed tax increases in all three areas this year, our region is very much in the middle of the pack of counties and cities in the state. Moreover, we’re considerably lower than the neighboring counties to the north that we compete with for residents and business opportunities.

Tax vs. Need

So what are the consequences of demanding ever-lower-taxes in a region where taxes are already relatively low? A quick survey of the region suggests more damage than good.

Spotsylvania’s school system is in the red, and in fact has been seriously underfunded for years.

The current school board majority came into office in part arguing that there had for too long been too much money spent in the schools, and that there was an enormous amount of waste. Mark Taylor, who before becoming superintendent had spend several years as the county’s administrator and refused to believe the school system when it demonstrated that it was underfunded, is a big reason the schools are in the bind that they’re in.

Now that Taylor’s in the supervisor’s seat, he’s come to realize that the ideological cry of waste was just that – a cry based on ideology and not reality. Taylor is demanding the board of supervisors send millions more to the school system – a system that he helped underfund during his tenure as administrator. And he’s going to increasingly disruptive means to try and put the Board of Supervisors on the spot and blame them for the shortfall, believing this will pressure them to support the enormous increase he is demanding.

Fredericksburg similarly is facing pressures to raise more money for needed improvements to the city. From the new middle school, to a fire station and a waste water treatment plant. The city is also facing enormous growth pains, as population soars along with housing costs, while a significant percentage of the city’s residents are categorized as ALICE (Asset Limited, Income Constrained, Employed). In short, these are working families who cannot earn enough to cover their expenses.

Stafford County, like Spotsylvania, is facing funding issues in schools. It’s also upping spending on first-responder salaries.

Predictably, all three areas are looking at tax increases this year, and will probably need to be risen in the years ahead.

Losing more than revenue

At the same time the United States was driving taxes down, we were simultaneously becoming a more individually (dare I say “selfishly”) centered people. Over the past 50 years, things that used to be thought of as social concerns – services and amenities that were beneficial to all and therefore were worth everyone’s supporting – have become increasingly privatized and profit-driven.

Health care. Education. Mail service. Roadways. Scientific Research. These are just some of the bigger changes.

And the changes have not always been for the better. Health care is again beyond the reach of far too many people, and bankrupting far too many families. A phenomenon that is unique among First World nations to the United States.

College education has soared beyond the ability of many middle class families to pay. This is due to states ceasing to fund higher ed, and universities (in the name of competition) engaging in a war to make their campuses more physically attractive to potential students. The result is tuition that for two decades has reason at a rate well-beyond the average inflation rate.

This list could go on, but the point is made.

This is a not a call to open the taxation floodgates and return to the top-level rates of the 1950s and 1960s. It is, however, a call to reason.

There are some things that we can achieve more together than we do individually. Health care. Education. And transportation are just three areas.

But to do these together, we are going to have to consider coming together and accepting higher tax rates to make these things happen.

The pendulum has swung so far against taxes in my lifetime, that we are losing sight of what unites us as a people.

So as the sting of tax day passes, remember that relative to our neighbors, we have it pretty good. And then thing how much more we can do for us all, if we’re willing to all give just a bit more.

NEWS: We’re Growing

F2S is pleased to announce that a new face will soon be joining the team. Watch next week for a young reporter who will help us expand our capacity to report on local government.