Analysis: "Stabilization," Yes; "Healthy"? Depends on Your Perspective

Diving into the monthly real estate report from the Fredericksburg Area Association of Realtors.

By Martin Davis

EDITOR-IN-CHIEF

Email Martin

In its press release announcing the August home sales report, the incoming president of the Fredericksburg Area Association of Realtors, Matthew Rathbun, described the housing market this way: “Sellers aren’t seeing the rapid pace of sales we’ve had in recent years, but the market remains balanced and healthy.”

Bottom line, Rathbun continued, “Overall, we’re in a period of stabilization rather than sharp swings, which is good news for long-term market confidence.”

There is certainly a case to be made for stabilization and health, but as has been the case for several months now, this remains a challenging market for those looking to move into a new home.

Stabilization, Health

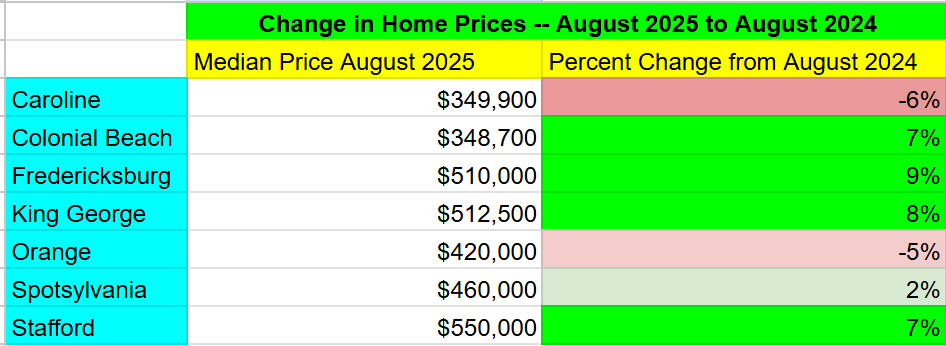

Across the region that the FAAR report covers (Caroline, Colonial Beach, Fredericksburg, King George, Orange, Spotsylvania, and Stafford) prices for homes are up a modest 5% when comparing August 2024 to August 2025. Helping this relatively modest jump is a gradual decline in mortgage interest rates.

At the end of May, the average mortgage rate for a 30-year fixed-interest mortgage was 6.97%, according to bankrate.com, and that number has been on a slow, steady decline ever since. As of September 16, that number is down to 6.37%.

Another indicator that the real estate industry looks to, months of inventory, is up 38% over August 2024 to 2.83 months. Months of inventory reflects that amount of time it would take to sell all homes on the market assuming that no new homes are added. Historically, four to five months of inventory is deemed healthy—anything above that indicates a buyers’ market and anything below indicates a sellers’ market.

While our market still favors sellers, the jump in inventory suggests that things are slowly getting better for buyers. (As is the case with most data points, however, “months of inventory” comes with important qualifications—see “Is Five Months of Supply Really the Sign of a Healthy Housing Market?” by Dr. Lisa Sturtevant on Virginiarealtors.org.)

Underlying Worries

While the market as a whole is steadying itself and flashing indicators that in normal times would suggest a level of health, there are some worrying signs.

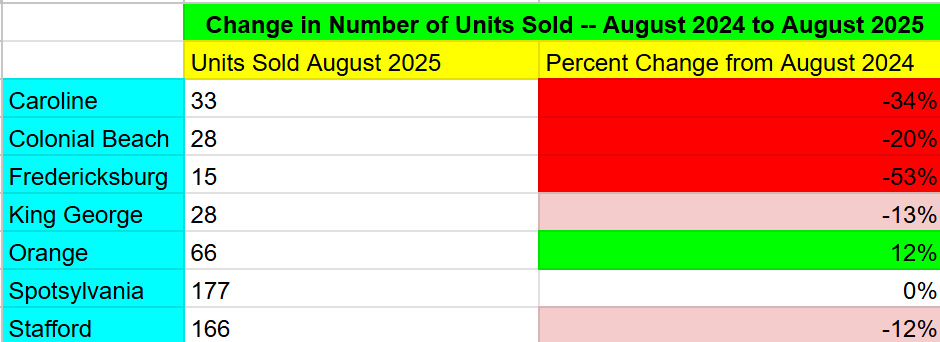

With the exception of Orange County, for example, every locality covered by FAAR saw home sales in August 2025 compared with home sales in August 2024 stay flat (Spotsylvania) or decline—in some cases, sharply.

Meanwhile, housing prices in each of these areas, with the exception of Caroline and Orange, continue to climb.

Home prices are not just high, they have been stubbornly high—indeed, climbing—for the past four years. That’s great news for those who own a home.

However, for those looking to enter the market, this means only those with substantial access to capital or high salaries are likely to be able to buy in.

Let’s consider, for example, the two most dynamic markets in our region—Spotsylvania and Stafford. Of the area FAAR serves, 67% of homes sold are in these two counties. So what does it cost to actually purchase a home in Spotsy or Stafford?

Dollartimes.com provides a useful calculator for getting a high-level look at the costs involved.

In Spotsylvania, for example, to buy a home at the median price of $460,000 with a traditional 30-year fixed-rate mortgage, a buyer with excellent credit getting a 6.32% loan and keeping their mortgage payment at 30% of total income would need:

20% down payment — $92,000

Annual household income — $91,305

The average household income in Spotsylvania County in 2023 according to Data USA? $109,576.

Compare that with Stafford, where the median price is $550,000:

20% down payment — $110,000

Annual household income — $109,169

The average household income in Stafford County in 2023 according to Data USA? $133,792.

There are, of course, multiple programs available for people who qualify that require far less money down. However, these numbers provide some guide to the costs of purchasing one’s way into home ownership.

That the average household income required to purchase a home, using Dollartime’s formulae, remains below the average household income in each county means that the market is still accessible to middle-income families.

However, federal job cuts and a lagging economy will be factors to watch in the months ahead.

So yes, the real estate market is relatively stable at the time. But uncertain waters are ahead — how our market navigates those waters remains to be seen.

And for those looking to buy their way into the market? While a stable market helps, high prices and relatively high interest rates continue to be a challenge.

Local Obituaries

To view local obituaries or to send a note to family and loved ones, please visit the link that follows.

Support Award-winning, Locally Focused Journalism

The FXBG Advance cuts through the talking points to deliver both incisive and informative news about the issues, people, and organizations that daily affect your life. And we do it in a multi-partisan format that has no equal in this region. Over the past year, our reporting was:

First to break the story of Stafford Board of Supervisors dismissing a citizen library board member for “misconduct,” without informing the citizen or explaining what the person allegedly did wrong.

First to explain falling water levels in the Rappahannock Canal.

First to detail controversial traffic numbers submitted by Stafford staff on the Buc-ee’s project

Our media group also offers the most-extensive election coverage in the region and regular columnists like:

And our newsroom is led by the most-experienced and most-awarded journalists in the region — Adele Uphaus (Managing Editor and multiple VPA award-winner) and Martin Davis (Editor-in-Chief, 2022 Opinion Writer of the Year in Virginia and more than 25 years reporting from around the country and the world).

For just $8 a month, you can help support top-flight journalism that puts people over policies.

Your contributions 100% support our journalists.

Help us as we continue to grow!

This article is published under Creative Commons license CC BY-NC-ND. It can be distributed for noncommercial purposes and must include the following: “Published with permission by FXBG Advance.”