Prosper Tax Services at Rappahannock United Way is Open for the 2025 Tax Season

Now in its 21st year, the program has provided free tax preparation services for households under a certain income threshold.

By Adele Uphaus

MANAGING EDITOR AND CORRESPONDENT

Email Adele

Jim Shelton has prepared hundreds of individual tax returns in his 10 years as a volunteer with the Rappahannock United Way’s Prosper Tax Services, but there are several that stand out for him.

Like the return he prepared for a man employed as a bricklayer’s apprentice. The man had only the one W2, so Shelton assumed it would be fairly straight-forward process, until he noticed that the W2 listed him as a “statutory employee.”

“I had never seen that before, so I had to figure out what that was,” Shelton said.

It meant the company wasn’t withholding taxes from the man’s salary.

“He was basically self-employed, and as a result, he owed a ton,” Shelton recalled. The man would also have to pay the tax penalty in place at the time for not having minimum essential health coverage.

“So I said, ‘OK, do you have expenses? Go home and figure out your mileage. Figure out what you spent on supplies, like steel-toed boots. But the first thing you have to do is go to Human Resources and get this changed right now.’”

The man came back with his expenses totaled. He still owed taxes but would no longer have to pay the health insurance penalty.

“I did his return the next year, and he was a normal employee,” Shelton said.

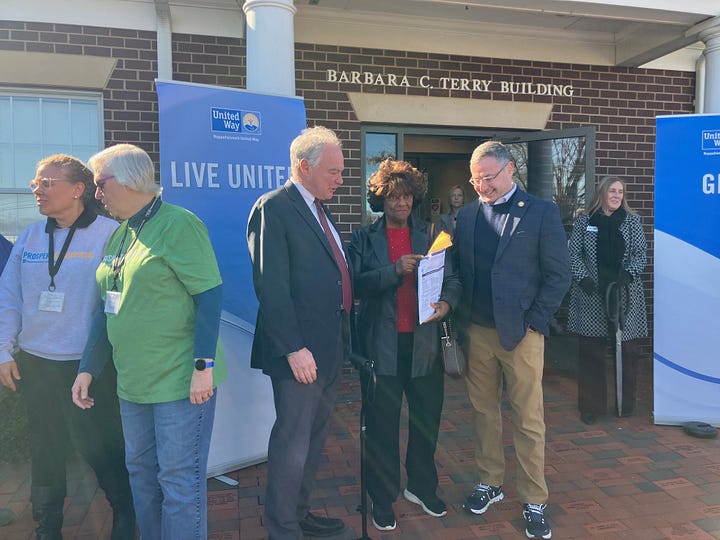

Experiences like that are what motivates Shelton to volunteer each year with the Rappahannock United Way’s free tax preparation program. He was in the audience along with other green-shirted, IRS-certified volunteer tax preparers for Monday’s ribbon cutting officially opening the 2025 tax season.

Prosper Tax Services is part of the IRS’s Volunteer Income Tax Assistance program. Now in its 21st year, the local United Way’s program is available for households making less than $84,000.

Since it was first offered, volunteers have filed 22,415 individual tax returns, putting millions in saved tax preparation fees and tax refunds into the local economy, RUW president Janel Donohue said at Monday’s ribbon cutting.

“This is not a charity. This is a business,” Donohue said. “Folks have told us they use their tax refund to pay off bills, invest in their children’s education, or [to help] buy a house.”

The 2025 tax preparation season will run from January 27 to April 15. Jessica Chavez, who runs the program for RUW, said the goal is to help 2,000 individuals prepare their taxes this year—exceeding last year’s total of 1,580.

Shortly before noon on Monday, there were already 10 people in line to have their taxes prepared.

Last year, 38 volunteer tax preparers helped local residents receive $1.4 million in tax refunds and save $395,000 in tax filing fees, according to highlights shared by RUW.

They also helped individuals save $266,548 through Earned Income Tax Credits.

Senator Tim Kaine, who attended Monday’s ribbon cutting along with Representative Eugene Vindman, said Congress has worked hard to pass tax initiatives such as the Earned Income Tax Credit and the Childcare Tax Credit, but that the tax code is complicated and if folks don’t know these credits are available, they won’t know to ask for them.

Shelton said that helping folks access these credits and find other ways to reduce their tax bill is extremely rewarding.

“We seem to do a fair number of tax returns for people who are self-employed and work in the gig economy, like Uber drivers,” he said. “It’s nice being able to help them, because if you go drive for Uber, they’ll tell you, ‘Here’s how you drive,’ but nothing about running the business side of it.”

“I can’t tell you how many didn’t have a clue about keeping track of mileage, and that kind of thing,” Shelton continued.

Alba Summers has had her taxes prepared by volunteers at the United Way since 2019. At that time, events in her life left her “almost homeless.” She didn’t have any savings, and as an immigrant from Colombia, she had no family to turn to. She had a job at Walmart and knew she would have to file taxes but had no idea how to go about it.

“As an immigrant, you want to do the right thing, so I have been filing taxes since I got here [in 2015],” Summers said. “I am a Green Card holder, but I still worry.”

Summers found her way to Empowerhouse, which in turn connected her with other organizations in the community that could help her. That’s how she found Prosper Tax Services.

“The volunteers are amazing,” she said. “They took all the stress from me.”

The United Way “helps the section of society that lives check by check,” said Summers, who eventually enrolled in Germanna Community College, and now is preparing to graduate from Old Dominion University with a degree in marketing.

“They are making it possible for the community to get stronger. It’s like somebody holding your hand.”

Local Obituaries

To view local obituaries or to send a note to family and loved ones, please visit the link that follows.

Support Award-winning, Locally Focused Journalism

The FXBG Advance cuts through the talking points to deliver both incisive and informative news about the issues, people, and organizations that daily affect your life. And we do it in a multi-partisan format that has no equal in this region. Over the past year, our reporting was:

First to break the story of Stafford Board of Supervisors dismissing a citizen library board member for “misconduct,” without informing the citizen or explaining what the person allegedly did wrong.

First to explain falling water levels in the Rappahannock Canal.

First to detail controversial traffic numbers submitted by Stafford staff on the Buc-ee’s project

Our media group also offers the most-extensive election coverage in the region and regular columnists like:

And our newsroom is led by the most-experienced and most-awarded journalists in the region — Adele Uphaus (Managing Editor and multiple VPA award-winner) and Martin Davis (Editor-in-Chief, 2022 Opinion Writer of the Year in Virginia and more than 25 years reporting from around the country and the world).

For just $8 a month, you can help support top-flight journalism that puts people over policies.

Your contributions 100% support our journalists.

Help us as we continue to grow!

This article is published under Creative Commons license CC BY-NC-ND. It can be distributed for noncommercial purposes and must include the following: “Published with permission by FXBG Advance.”